Sep . 22, 2024 21:00 Back to list

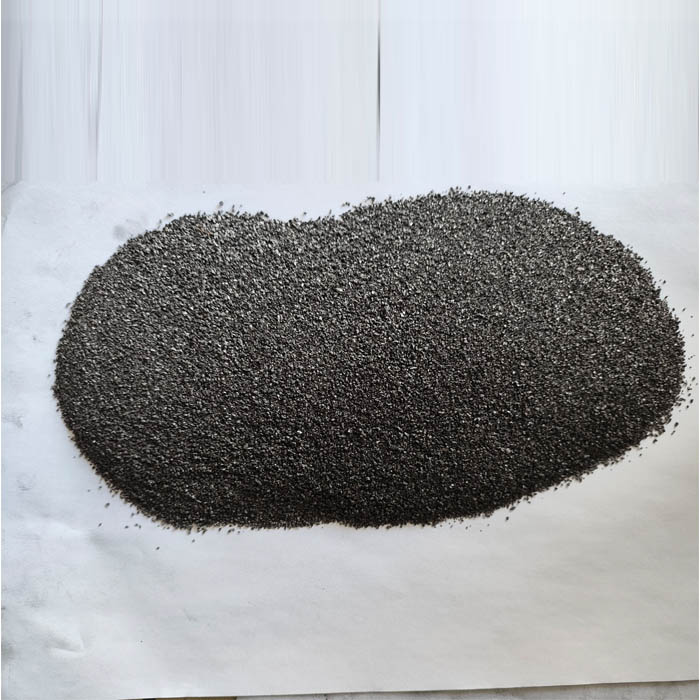

80 20 talc graphite exporters

The Dynamics of Talc and Graphite Exporters A Focus on 80% and 20% Markets

In the realm of industrial minerals, talc and graphite stand out for their unique properties and myriad applications. As global demand for these materials evolves, understanding the patterns of their export markets becomes crucial. This article delves into the dynamics of talc and graphite exporters, particularly focusing on the significant contributions of the 80% and 20% segments.

The Dynamics of Talc and Graphite Exporters A Focus on 80% and 20% Markets

Conversely, the remaining 20% of talc exports find their way into specialized markets, catering primarily to the pharmaceutical and food sectors. This niche is experiencing growth due to the increasing demand for high-quality, purified talc that complies with stringent regulatory standards. As health and safety regulations strengthen globally, producers who can provide high-purity talc are well-positioned to capture market share.

80 20 talc graphite exporters

On the other hand, graphite, known for its excellent conductivity and lubricating properties, plays a vital role in the technology and automotive sectors. The global graphite market is marked by a significant divide, with the 80% segment largely addressing the needs of battery production, particularly in the booming electric vehicle (EV) market. As countries push towards sustainable energy solutions, the demand for high-quality graphite for lithium-ion batteries has surged.

The remaining 20% of graphite exports cater to various industrial applications, including lubricants, fuel cells, and steel production. This segment, while smaller, remains essential, with specific characteristics in demand that vary across different industries. Countries such as China, Brazil, and Canada dominate this market, leveraging their natural resources and technological advancements to meet international standards.

The interplay between the 80% and 20% segments in both talc and graphite markets illustrates the complexity of global trade in industrial minerals. Factors such as geopolitical dynamics, trade regulations, and consumer preferences significantly influence export patterns. As the world shifts towards greener technologies, the demand for these minerals is likely to continue adjusting, with producers needing to remain agile and responsive to market shifts.

In conclusion, talc and graphite exporters are navigating a multifaceted landscape marked by distinct market segments. The 80% of talc primarily supporting industrial applications, and the corresponding 20% tailored for specialized uses, emphasizes the importance of adaptability in production and marketing strategies. Similarly, graphite’s division highlights the critical role of innovation and investment in meeting the evolving demands of various industries. As both markets continue to grow, exporters must stay abreast of trends and regulatory changes to maintain their competitive edge.

-

Eco-Friendly Granule Covering Agent | Dust & Caking Control

NewsAug.06,2025

-

Fe-C Composite Pellets for BOF: High-Efficiency & Cost-Saving

NewsAug.05,2025

-

Premium Tundish Covering Agents Exporters | High Purity

NewsAug.04,2025

-

Fe-C Composite Pellets for BOF | Efficient & Economical

NewsAug.03,2025

-

Top Tundish Covering Agent Exporters | Premium Quality Solutions

NewsAug.02,2025

-

First Bauxite Exporters | AI-Optimized Supply

NewsAug.01,2025