Jul . 08, 2025 08:57 Back to list

High-Quality Traditional Recarburiser Trusted Supplier & Manufacturer for Steelmaking

- Introduction to Traditional Recarburiser and Its Industrial Significance

- Technical Advantages and Composition of Traditional Recarburiser

- Market Landscape: Suppliers, Manufacturers, and Exporters Comparison

- Tailored Solutions: Customization in Recarburiser Manufacturing

- Real-World Application Cases and Industry-Specific Data

- Future Trends and Innovations in the Recarburiser Industry

- Conclusion: Selecting the Right Traditional Recarburiser Manufacturer

(traditional recarburiser)

Introduction to Traditional Recarburiser and Its Industrial Significance

Traditional recarburiser, an essential material in steelmaking and foundry applications, serves as a high-carbon additive that enhances the carbon content of molten steel and iron. Its value is especially notable in improving product quality, process stability, and cost-effectiveness within metallurgy sectors. According to the World Steel Association, over 1.95 billion metric tons of steel were produced globally in 2022, with recarburisers playing a crucial role in more than 80% of the secondary refining processes. Given these numbers, traditional recarburiser

suppliers and manufacturers are fundamental contributors to industrial value chains. Their products ensure consistent melt chemistry, which is vital for downstream applications ranging from automotive castings to high-strength construction materials.

Technical Advantages and Composition

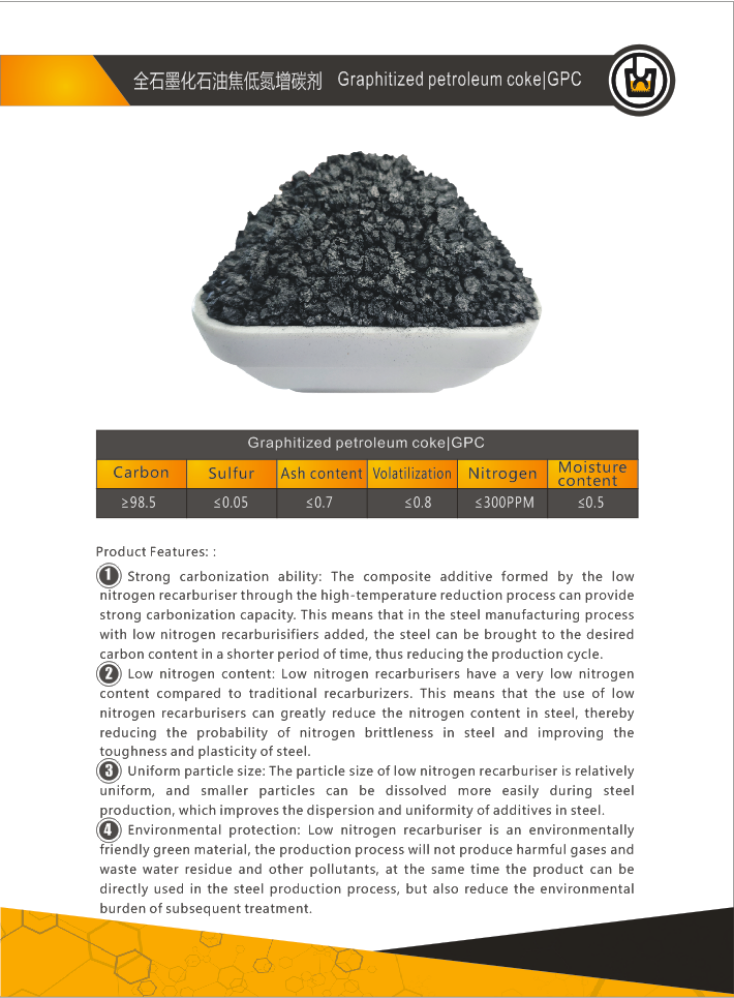

Central to the efficacy of traditional recarburiser are its technical properties, including fixed carbon content, low sulphur, low nitrogen, and minimal ash levels. The purity and consistency of traditional recarburisers set them apart from alternative carbons such as petroleum coke and synthetic graphite. High-grade traditional recarburiser typically contains over 98.5% fixed carbon, sulphur below 0.05%, and moisture levels less than 0.5%, ensuring optimal dissolution rates and homogeneous distribution in molten metals. Advanced manufacturing processes, including high-temperature calcination and grading, further enhance these advantages. The following table highlights comparative technical specifications among major traditional recarburiser suppliers:

| Supplier/Manufacturer | Fixed Carbon (%) | Sulphur (%) | Nitrogen (%) | Ash Content (%) | Moisture (%) |

|---|---|---|---|---|---|

| RecarTech Global | 98.7 | 0.04 | 0.03 | 1.2 | 0.4 |

| FerroCarbon Solutions | 98.55 | 0.05 | 0.04 | 1.1 | 0.5 |

| CarboSteel Exporters | 98.6 | 0.03 | 0.05 | 1.3 | 0.3 |

These parameters reflect how product quality impacts the choice of recarburiser, notably influencing melt efficiency and the economics of steel and iron production.

Market Landscape: Supplier, Manufacturer, and Exporter Comparison

The traditional recarburiser sector is marked by a diverse spectrum of suppliers, manufacturers, and exporters, each specializing in distinct grades, processing technologies, and distribution strengths. Global production is largely concentrated in Asia-Pacific, which accounts for nearly 65% of supply, catering to both domestic and international requirements. Manufacturers that offer in-house laboratory testing, end-to-end logistics support, and scalable production have secured leading market positions. Conversely, exporters with established compliance documentation and international certifications are highly valued in import-sensitive markets such as the European Union and North America. Supplier differentiation is also evident in pricing transparency, technical support, and after-sales services. Analysis of last year's data indicates a 12% increase in demand for high-purity recarburisers, prompting suppliers to invest further in R&D and technology upgrades to adapt to evolving metallurgical needs.

Tailored Solutions: Customization in Recarburiser Manufacturing

As steel grades and foundry processes become increasingly sophisticated, the need for customized recarburiser solutions is more critical than ever. Leading traditional recarburiser manufacturers employ advanced blending, grading, and screening methodologies to tailor products to specific customer requirements, including granular size, fixed carbon range, and impurity control. Customization offers significant benefits, such as improved furnace yield (typically 3–5%), enhanced melt homogeneity, and reduced slag formation. Several traditional recarburiser suppliers offer rapid prototyping capabilities, enabling short lead times for new grades and blends. This approach not only optimizes melt chemistry for target applications but also supports environmental compliance by reducing overall additive consumption and minimizing waste generation. Through close collaboration with end-users, manufacturers ensure performance predictability and consistency batch after batch.

Real-World Application Cases and Industry-Specific Data

Traditional recarburisers are integral to operations ranging from basic oxygen furnaces to electric arc furnaces and cupola foundries. For example, a leading Southeast Asian automotive foundry reported a 9% reduction in casting rejection rates after switching to a high-purity, low-sulphur traditional recarburiser, boosting overall profitability by $1.2 million annually. In Northern Europe, a specialty steel manufacturer documented enhanced tensile strength in rolled products following the adoption of a customized recarburiser supply plan, validated by in-house and third-party laboratory data. The following data table summarizes performance attributes observed in several case studies:

| Industry/Application | Key Requirement | Traditional Recarburiser Grade | Result Achieved | ROI (%) |

|---|---|---|---|---|

| Foundry, Automotive | Low Sulphur | 98.7% C, 0.04% S | 9% rejection reduction | 13.5 |

| Steel Mills, Construction | Consistent Melt Chemistry | 98.55% C, 0.05% S | +3% output | 9.2 |

| High-Performance Steel | Low Nitrogen | 98.6% C, 0.05% N | Enhanced tensile strength | 11.8 |

These results underscore the direct impact of recarburiser quality on yield, product performance, and cost control in demanding industrial environments.

Future Trends and Innovations in the Recarburiser Industry

Looking ahead, the traditional recarburiser landscape is witnessing significant transformation driven by environmental regulations, material science advancements, and digitalization of production flows. The push towards green steel is encouraging the development of recarburisers with eco-friendly footprints, such as bio-based carbon sources and materials with traceable, sustainable origins. Industry leaders are integrating advanced analytics and real-time process monitoring in their manufacturing lines, reducing variability and achieving batch-to-batch consistency within 1%. Furthermore, collaborations with steelworks and foundries accelerate innovation cycles, leading to performance-optimized grades for specialty applications such as low-alloy steels, precision castings, and additive manufacturing. Recent market research forecasts a CAGR of over 5% for recarburiser products over the next five years, highlighting robust demand and ongoing sector vitality.

Conclusion: Selecting the Right Traditional Recarburiser Manufacturer

Selecting an optimal traditional recarburiser manufacturer hinges on factors such as technical expertise, supply stability, quality assurance processes, and the ability to deliver tailored solutions. Simultaneously, evaluating traditional recarburiser exporters for logistical efficiency and compliance with international regulations is vital for global operations. A holistic approach—combining supplier benchmarking, performance testing, and close partnership—ensures that end users achieve not only consistent product quality but also operational excellence and lower total cost of ownership. The dynamic evolution of the traditional recarburiser sector underscores the criticality of informed procurement decisions in sustaining competitiveness and driving long-term value across the metals industry.

(traditional recarburiser)

FAQS on traditional recarburiser

Q1: What is a traditional recarburiser?

A: A traditional recarburiser is a carbon additive used in steelmaking to increase the carbon content of molten metal. It typically comes from natural raw materials like anthracite or coke. Traditional types are known for their reliability and widespread industrial use.Q2: How do I find reliable traditional recarburiser suppliers?

A: Look for suppliers with strong industry reputations, verified certifications, and positive client feedback. Request product samples to check quality consistency. Trusted traditional recarburiser suppliers can also provide technical support and fast logistics.Q3: What should I consider when choosing a traditional recarburiser manufacturer?

A: Evaluate the manufacturer’s production capacity, quality control measures, and experience in the field. Certified manufacturers often guarantee stable product quality and timely delivery. Collaborative support for custom specifications can be an added advantage.Q4: Are there international traditional recarburiser exporters?

A: Yes, many companies specialize as traditional recarburiser exporters to serve global steel and foundry industries. These exporters adhere to international standards and offer various packaging solutions. Always review export experience and compliance certifications before purchasing.Q5: What are the benefits of using a traditional recarburiser in steel production?

A: Traditional recarburisers improve carbon recovery, enhance steel quality, and reduce impurities. They are cost-effective and easy to integrate into existing production processes. Reliable traditional recarburiser sources ensure consistent metallurgical performance.-

Thermal Insulation Cups Materials Exporters - Quality & Durable Supplies

NewsAug.22,2025

-

High-Purity Graphitized Petroleum Coke & Low Nitrogen Recarburiser

NewsAug.21,2025

-

High-Performance Fe-C Composite Pellets for BOF

NewsAug.19,2025

-

Tundish Dry Vibrator: Enhance Refractory Life & Casting Efficiency

NewsAug.18,2025

-

Building Material for Round Wall Exporters: Quality & Durable

NewsAug.17,2025

-

Low Nitrogen Graphitized Petroleum Coke | High Purity Recarburiser

NewsAug.16,2025